I want to write an essay on how reputation economies could make voluntary basic incomes possible. If things go right, it should become part of the second Transpolitica book. Here’s the abstract:

Advanced reputation systems provide the basis for an emerging reputation

economy. In turn, a reputation economy provides unprecedented

possibilities and incentives for voluntary basic income systems. There

are multiple ways in which a mature reputation economy could make

voluntary basic incomes feasible. These voluntary basic incomes have the

clear advantage of not requiring large political interventions in order

to operate successfully, and thus could be implemented faster and

easier. Voluntary basic incomes could play an alternative or

complementary role to a more conventional universal basic income.

What I want to write about is:

- What voluntary basic income systems already exist or are planned: http://www.basicincome.co/ for example (what else is there?)

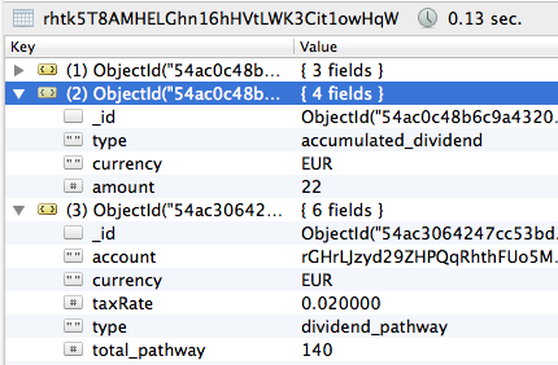

- What a reputation economy is and how it could work (for example with Quantified Prestige)

- How reputation economies can be used to make voluntary basic income systems work. There are different routes for that. For example, QP can have a predefined basic income. Another alternative is that people start expecting companies or DACs to pay voluntary basic incomes. If they pay more than expected, the reputation of those companies rises. If they pay less, their reputation falls, so that they will have problems staying viable in a really mature reputation economy.

If you have any suggestions what I should write about exactly, I would be grateful

This might be of special interest for @Darklight

It’s good to see you here among this small group of innovative thinkers. Your Resilience idea has fascinated me, and I’m still struggling to understand it completely.

It’s good to see you here among this small group of innovative thinkers. Your Resilience idea has fascinated me, and I’m still struggling to understand it completely.